Managing Employees in Province Payroll

Province Payroll makes it easy to manage employees across their full employment lifecycle. This article covers what you’ll find on the Employee List Page and the individual Employee Profile Page.

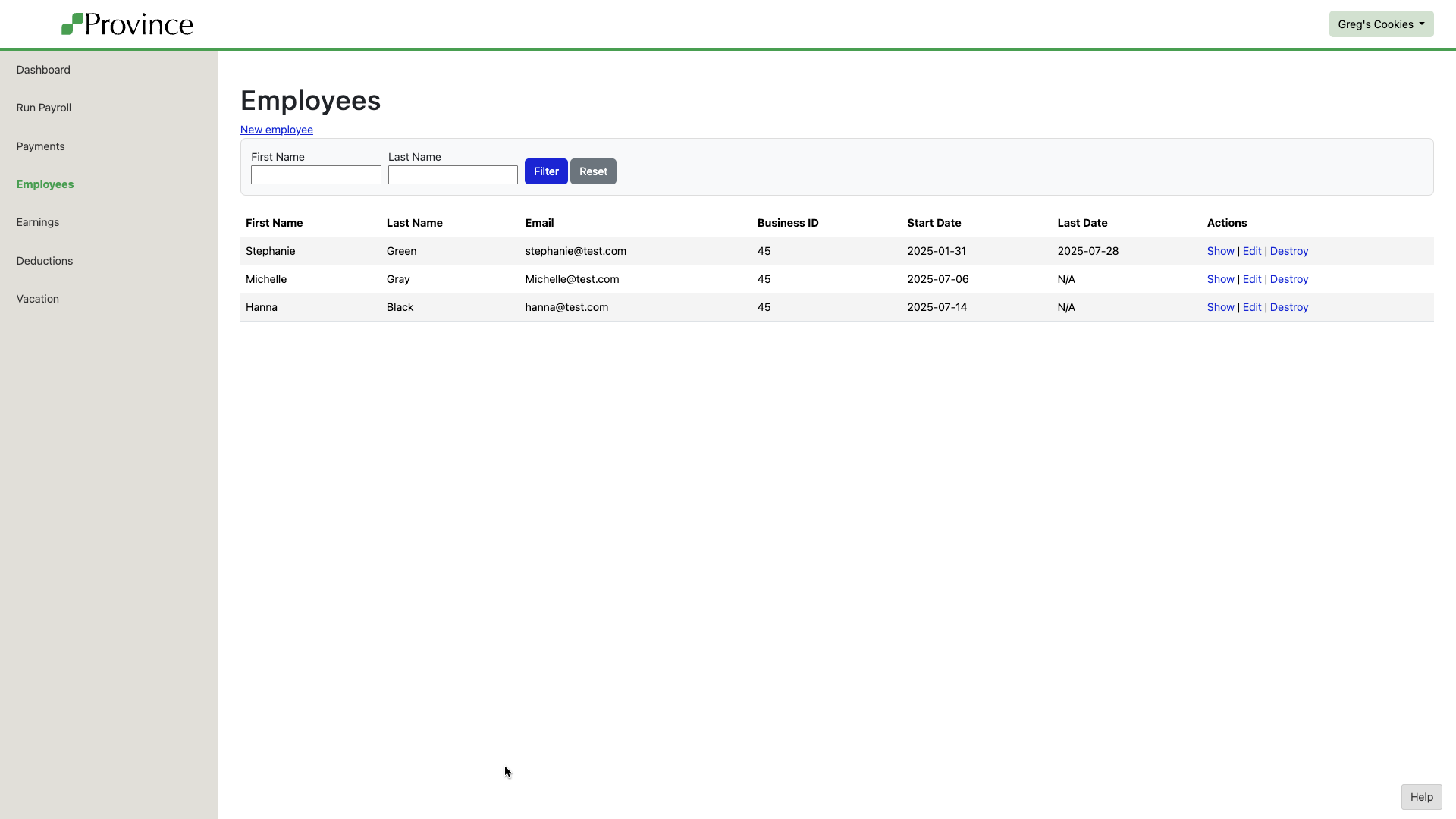

👥 Employee List Page

The Employee List page shows all employees in your business, along with a basic summary of their employment status.

Use the New Employee button to add a new team member.

You can filter the list by first or last name to find employees quickly.

Click "Show" on an employee's line to view their profile.

You can permanently delete an employee using the Delete link—but only if they have never been paid and have no earnings or deductions on record. If an employee has payroll history, they cannot be deleted. This protects your business's payroll audit trail.

👤 Employee Profile Page

Each employee profile is organized into key sections that show core identifying information and payroll-relevant data. Here's what each section includes and how it's used:

Profile

Name

Email is used to email the paystub to the employee on pay day.

Province of Employment determines which provincial tax rules apply to the employee. This field affects payroll calculations and T4 filings.

Date of Birth is used to determine eligibility for CPP. If it's not entered, Province will calculate CPP by default.

SIN (Social Insurance Number) is used for tax reporting and CRA submissions. If the SIN is not provided, Province will still run payroll but may block year-end filings (e.g., T4) until it’s added.

You can edit this section by clicking Edit this employee.

Address

This section displays the employee’s current mailing address. It’s used for T4s and CRA purposes. If no address is on file, you can add one using Add employee address.

Employment Periods

This section shows the full history of the employee’s employment with your business.

Each period includes a start date and, if applicable, a last date.

An employee can have multiple periods if they are rehired.

From this section, you can:

Terminate an active employee (see: [How to Terminate an Employee])

Rehire an inactive employee (see: [How to Rehire an Employee])

Wage

This section displays the employee’s current and historical wage information.

You’ll see details like:

Compensation Type – e.g., Hourly or Salary

Wage Amount – the base hourly or salary rate

Vacation Rate – the percentage of earnings allocated for vacation pay

Compensation Start and End Dates – when this wage became active and, if set, when it ends

You'll also see the standard schedule assigned to this wage. This schedule tells Province Payroll when the employee is expected to work. When you click Generate Earnings on the Pay Run page, Province will automatically create shifts for each scheduled day.

The Compensation End Date is optional. Use it if you know when the employee’s pay should stop—for example, for a short-term contract. Otherwise, leave it blank. Province will automatically populate the end date when the employee is terminated or assigned a new wage.

From this section, you can:

Add a new wage using Add employee wage

Review past records by clicking View wage history

For more detail:

[How to Add a New Wage]

[Understanding Wage Proration by Province]

Active Tax Credits

This section displays the most recent TD1 form entered for each applicable jurisdiction.

Province always uses the most recently submitted TD1 for the year when calculating payroll.

If no TD1 is present for a given year, the system uses the government’s default basic personal amount.

You can:

Add a new federal TD1

Add a new provincial TD1

View TD1 history for the employee

For related help:

[Enter Tax Credits/TD1]

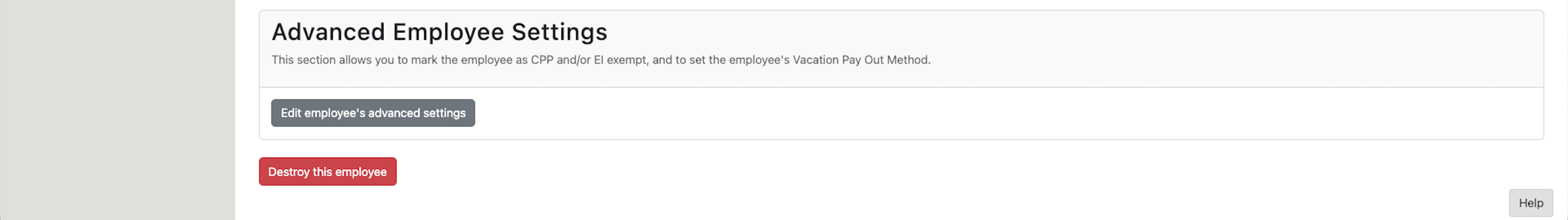

Advanced Employee Settings

This section allows you to configure:

CPP and EI exemption flags

The employee’s Vacation Pay Out Method

Set the employees Labour Province, if it differs from their Province of Employment

Click Edit employee's advanced settings to make changes.

Destroy This Employee

The “Destroy this employee” button permanently deletes the employee from your account.

🔒 Important: This action is only available if the employee has never been included on a payroll. Once an employee appears on any pay run—past or present—they are part of the official payroll history and cannot be deleted.

If the employee was added by mistake and has never been paid, this option lets you clean up your records.