Running Payroll

The Pay Runs page lists all payrolls that have been processed in Province. It’s your control centre for reviewing past payrolls and creating new ones.

📋 Viewing Pay Runs

Click New Pay Run to start a new payroll.

Note: You can only have one open Pay Run at a time.

On this page you’ll see a list of all historic Pay Runs, including their status.

Under the Actions column, click Show to view details.

If a Pay Run has the status of Open, that means it hasn’t been approved yet—and you can still delete it if needed.

✅ Reviewing and Approving a Pay Run

At the top of the Pay Run page, you’ll see:

Text telling you if the pay run is Open or Approved

The start date, end date, and pay date

The Pay Run workflow follows four key steps:

(1) Apply Schedules

Click this to auto-create earnings for employees with a fixed schedule. Their regular hours are pulled from the wage you already set—no manual entry needed.

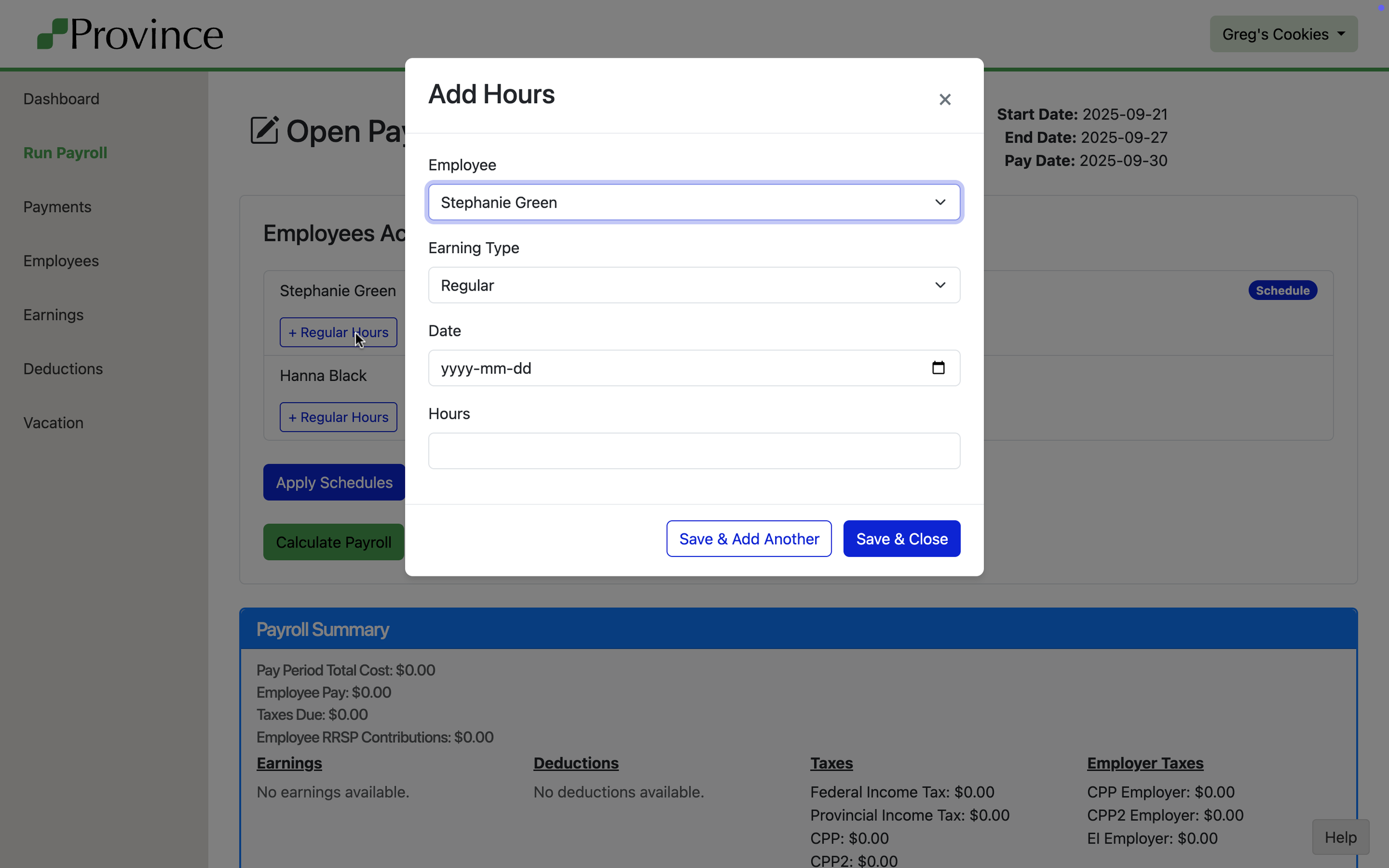

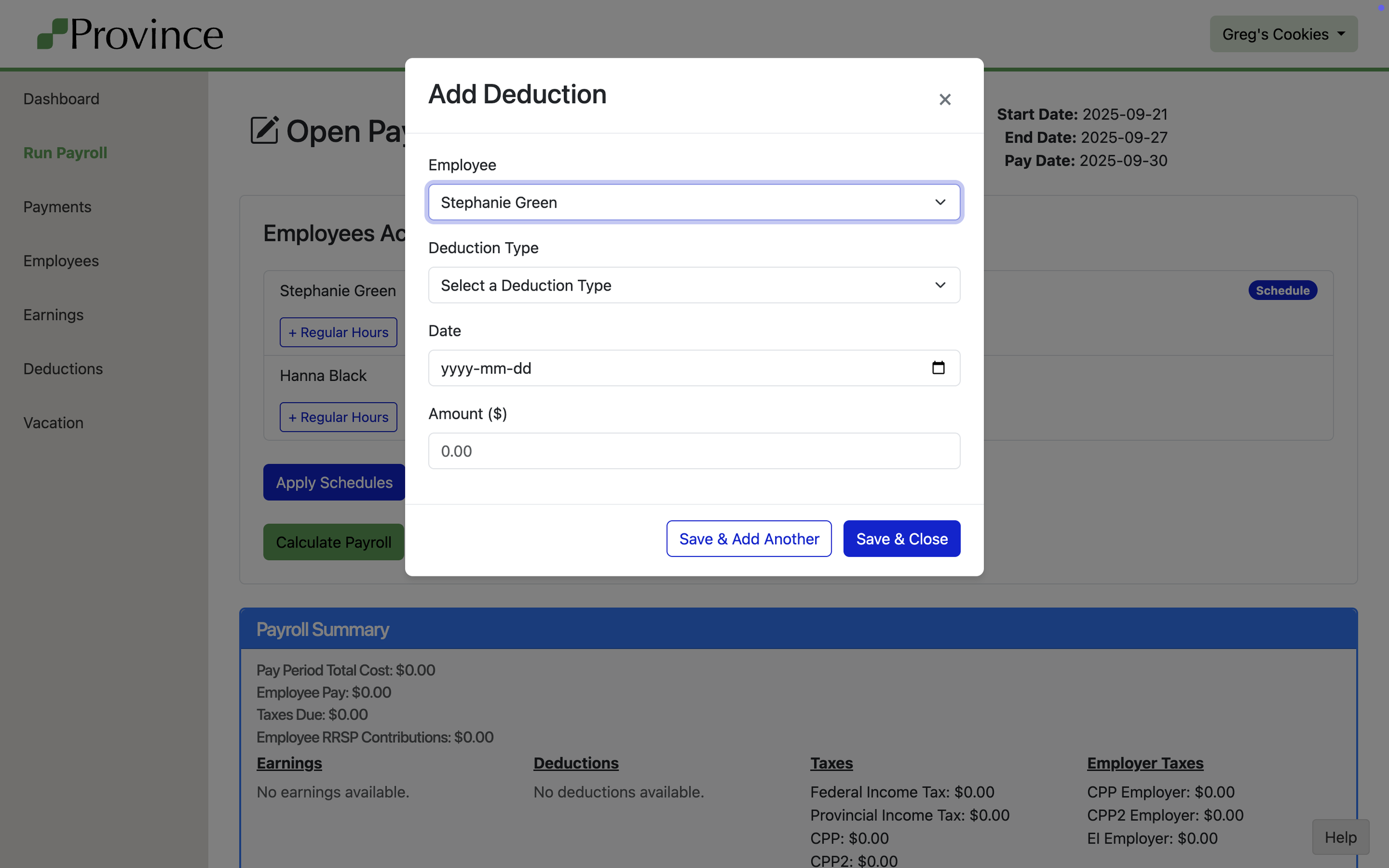

(2) Add Hours, Dollars or Deductions

For employees who worked different hours, took time off, or earned a bonus:

Click + Regular Hours, + Other Hours, + Dollars, or + Deduction to enter additional details.

For every type, a modal will open to enter the details

(3) Calculate Payroll

Clicking Calculate Payroll will refresh the page and display a summary of each employee’s:

Total hours

Gross pay

Taxes withheld

You can click this button as many times as you like. Nothing is committed to your business until the next step. It's a safe way to review and validate the payroll numbers before finalizing.

As part of this process, Province also runs a series of checks to catch common issues—like missing hours or zero net pay. Learn more about what Province Payroll checks before you approve a Pay Run.

(4) Approve Pay Run

Once everything looks good, click Approve Pay Run to lock in the results.

After approval:

Pay stubs are automatically emailed to employees on the Pay Date. Want to send them right away? Just click Email Paystub to send instantly.

Payment Tracking records to Employees and the CRA are created and available in the Payments page.