🚀 Getting Started with Province Payroll

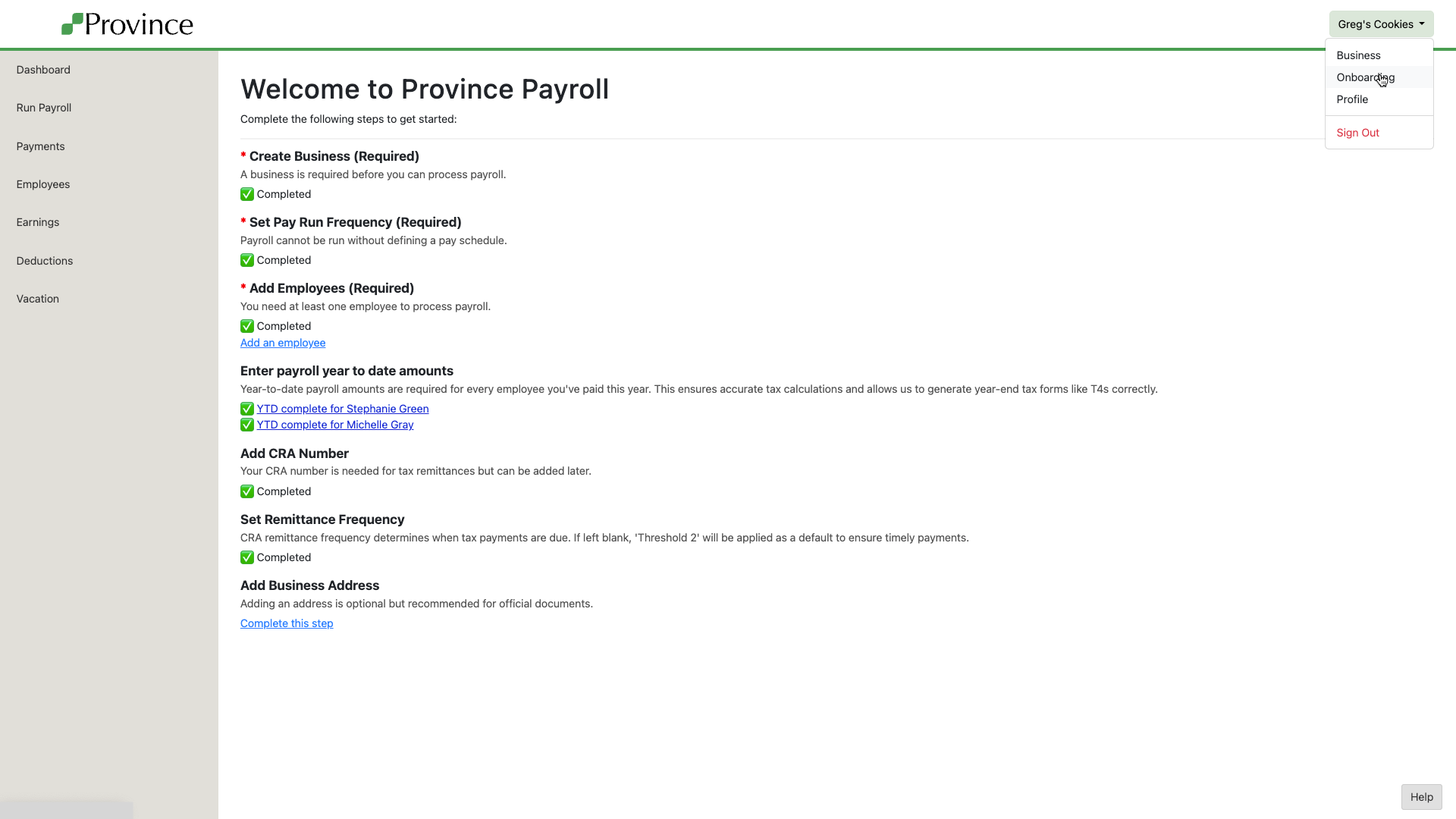

Welcome to Province Payroll! To help you launch smoothly, we’ve created a guided Onboarding Page with a checklist of essential setup steps.

We also offer a series of short Getting Started Videos to walk you through each step visually.

🔁 Returning to the Onboarding Page

During setup, Province will automatically redirect you back to the Onboarding page if any required steps are incomplete.

Once all required steps are complete, you can return to this page manually at any time by clicking the Business button in the top right corner of any page and selecting Onboarding from the dropdown menu.

✅ Required Steps to Run Payroll

These three steps are mandatory before you can run payroll:

Create Business

This is the first step when you create your account. It will always appear as "Completed" once you're on this screen.Set Pay Run Frequency

Province uses your frequency to automatically determine the start and end dates of each pay run. You can’t run payroll without it.Add Employees

You must have at least one employee in your account before you can process payroll.

🧾 Recommended Setup (but not required to start)

Enter Year-to-Date Payroll Amounts

If your business has paid employees earlier in the year (before using Province), you must enter year-to-date payroll amounts for each of those employees. This ensures:Accurate tax calculations

Correct year-end reporting (like T4s)

Add CRA Number

This number is required for Province to make tax remittances and file with the government on your behalf. If it’s blank, we won’t be able to file.Set Remittance Frequency

This tells Province when your CRA tax payments are due.If you don’t enter one, we’ll default to Threshold 2, CRA’s most frequent payment schedule, to help you avoid late remittances.

You can update this at any time; it applies to future pay runs only.

Add Business Address

Optional, but strongly recommended. This address is used on official documents and reports (like pay stubs and T4s).

Once all necessary steps are complete, you’ll be ready to run your first payroll.