How to Enter Earnings & Deductions

At the core of Province Payroll are two key building blocks: Earnings and Deductions.

Earnings = what the employee earns. This could be hours worked in a shift, a bonus, or any other type of income.

Deductions = amounts withheld from the employee’s pay. For example, RRSP contributions, or the employee’s portion of their health and dental benefits.

Your job is to enter Earnings and Deductions accurately. Province handles the rest—calculating taxes, vacation pay, and net pay.

🧾 Two Types of Earnings in Province

Earnings in Province fall into two categories:

1. Earnings With Hours

These earnings require insurable hours to be recorded. This is a federal requirement for accurate Record of Employment (ROE) reporting, which is used to determine eligibility for Employment Insurance.

These earning types must include hours:

Regular

Overtime

Holiday Premium Pay

Statutory Holiday Pay

Vacation (when time off is taken)

You’ll be prompted to enter the date of the earning and the number of hours worked. Province will then use the employee’s wage for that specific day to automatically calculate the correct pay amount.

2. Earnings Without Hours

These earnings do not require insurable hours because they’re not replacing time the employee worked or was expected to work. Instead, they represent payments unrelated to the regular work schedule—like bonuses, taxable benefits, or termination payments.

Examples include:

Bonuses

Different types of taxable benefits

Allowances

Vacation pay (when no time off is taken)

Pay in Lieu of Notice

Retiring Allowances / Severance Pay

For these, you’ll simply enter the amount—no hours are needed.

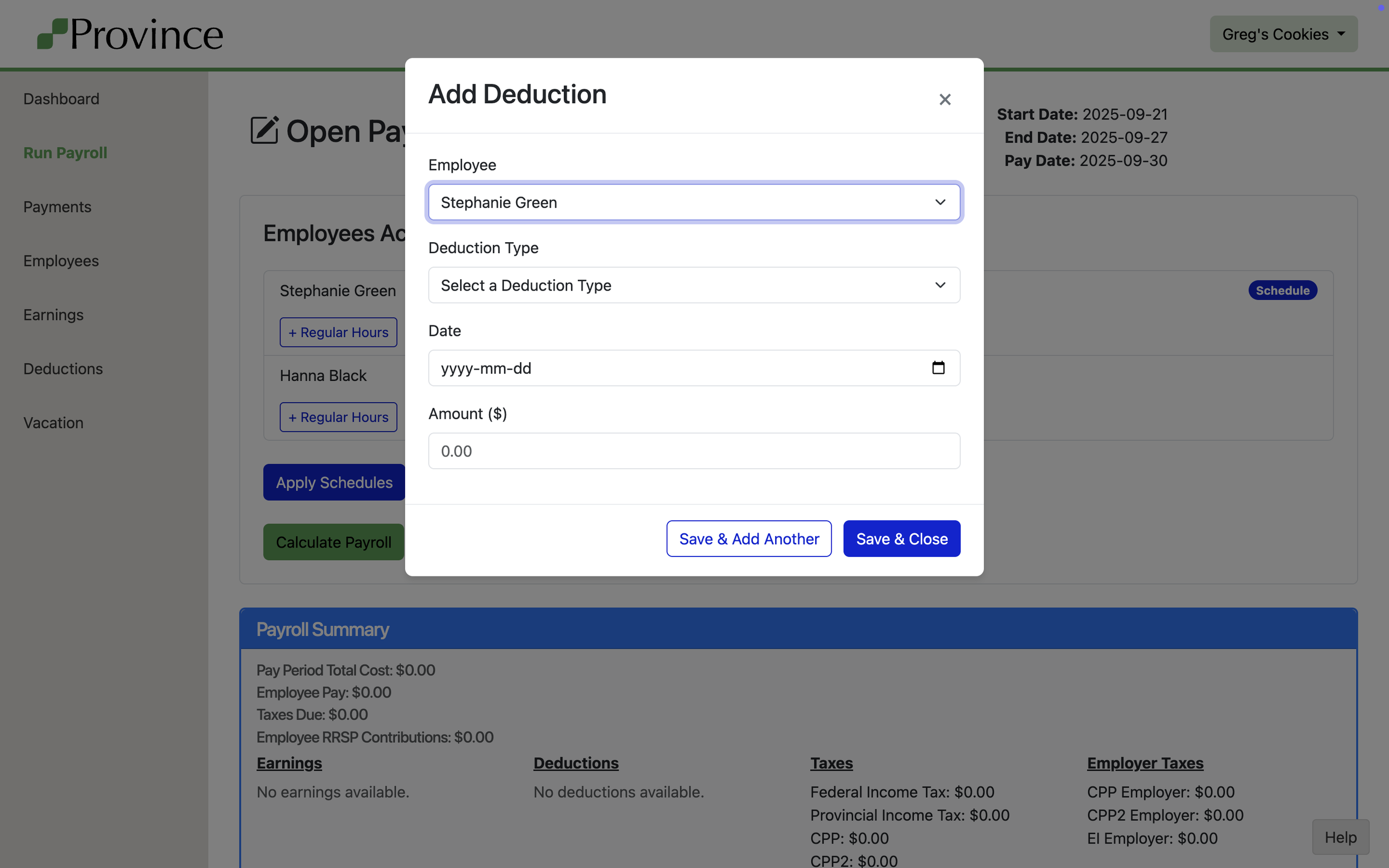

✍️ How to Enter an Earning or Deduction

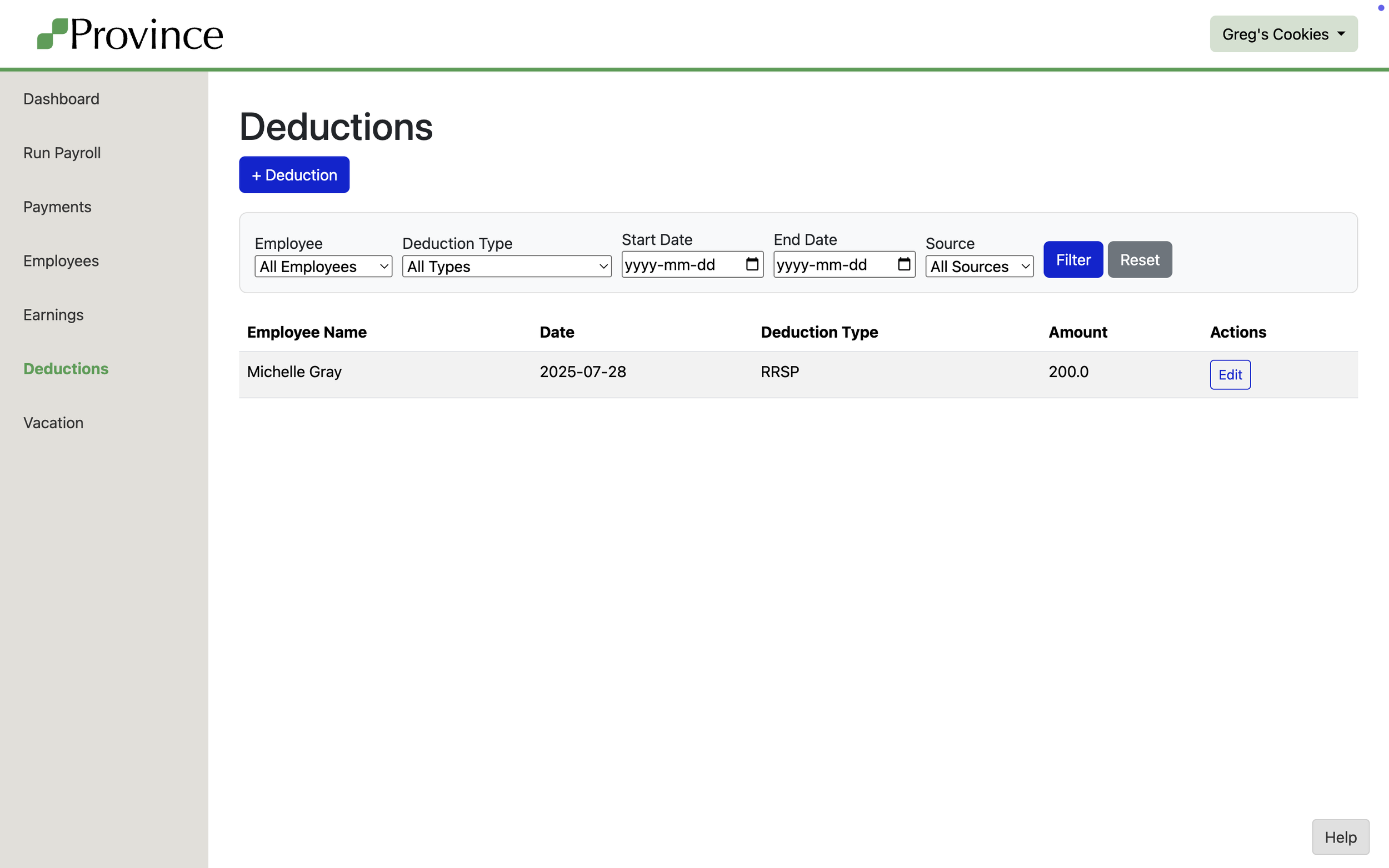

Each entry shows:

Employee Name

Date

Deduction Type

Amount

You can also add new deductions using the + Deduction button.

Help Center

Earnings & Deductions

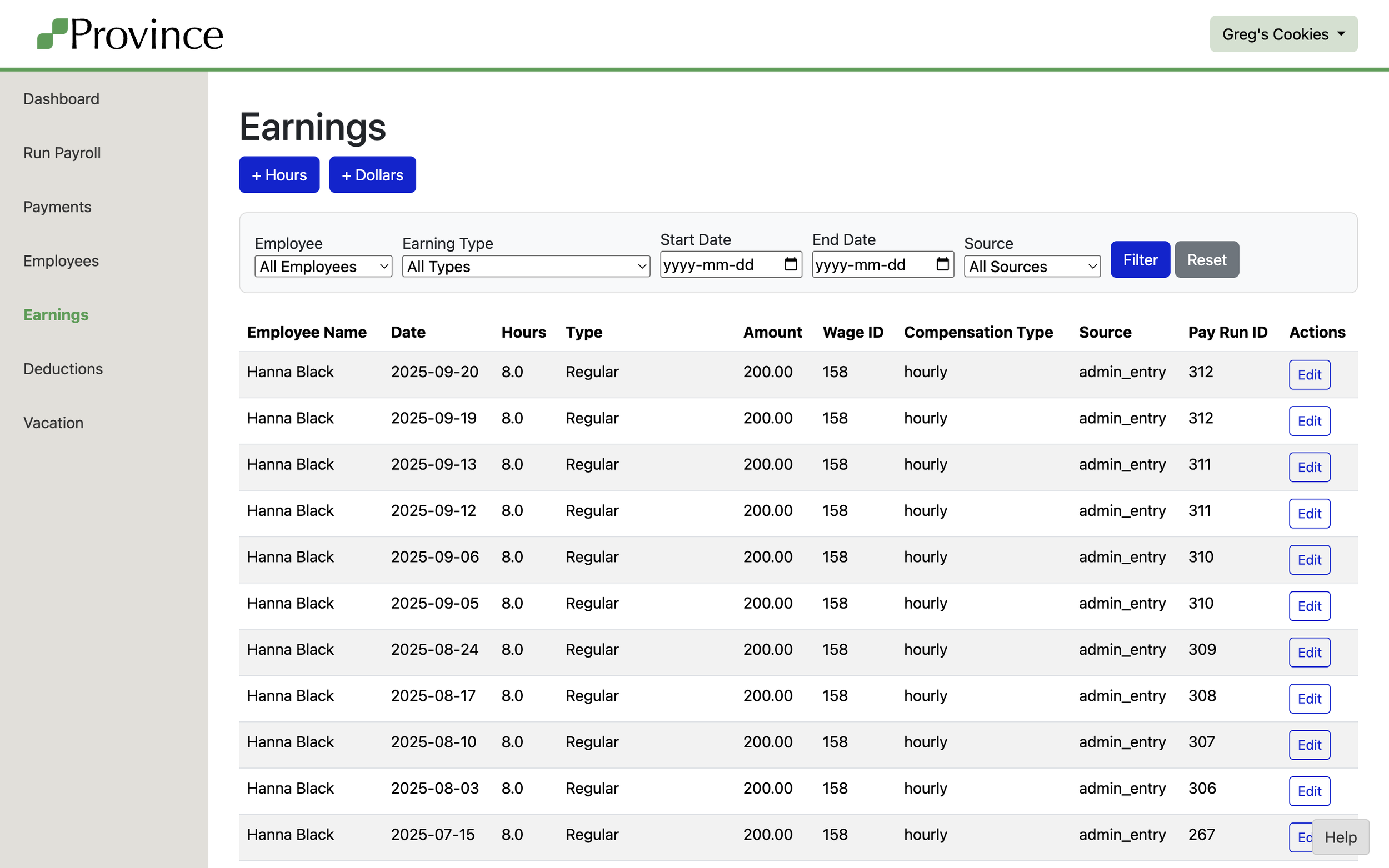

📋 Viewing and Filtering Earnings & Deductions

From the main Earnings and Deductions pages, you can view and filter all entries recorded for your business.

Earnings Page

To enter a new earning or deduction, simply click “+ Hours”, “+ Dollars”, or “+ Deductions” from the Run Payroll page, or the Earnings/Deductions pages and fill out the form as it appears on the screen:

Select the employee

Enter the date

Choose the Earning Type or Deduction Type

Enter the hours or amount based on the type

Click Create Earning or Create Deduction

Key Notes:

Editability: You can edit an earning or deduction up until the moment the pay run is approved. Once the pay run is approved, all associated earnings and deductions are locked.

Wage Used: Earnings with hours use the employee’s wage that is applicable on the date of the earning. For accurate payroll, it’s best practice to enter new wages as soon as they take effect.

Accuracy Matters: Always choose the earning or deduction type that accurately reflects the reason for the payment or withholding. This ensures your payroll remains legally compliant and accurate for tax reporting, ROEs, and T4s.

📌 Need a different earning or deduction type? Province Payroll has added the most common income and deduction types, but we understand that some users may need one we don’t have. Please reach out to us at help@provincepayroll.com for assistance.

Each entry shows:

Employee Name

Date

Hours (if applicable)

Earning Type

Amount

Wage ID and Compensation Type

Source

Associated Pay Run ID (if applicable) – the Pay Run ID is assigned when you click Calculate Payroll

You can also create a new entry using:

+ Hours

+ Dollars