Business Settings

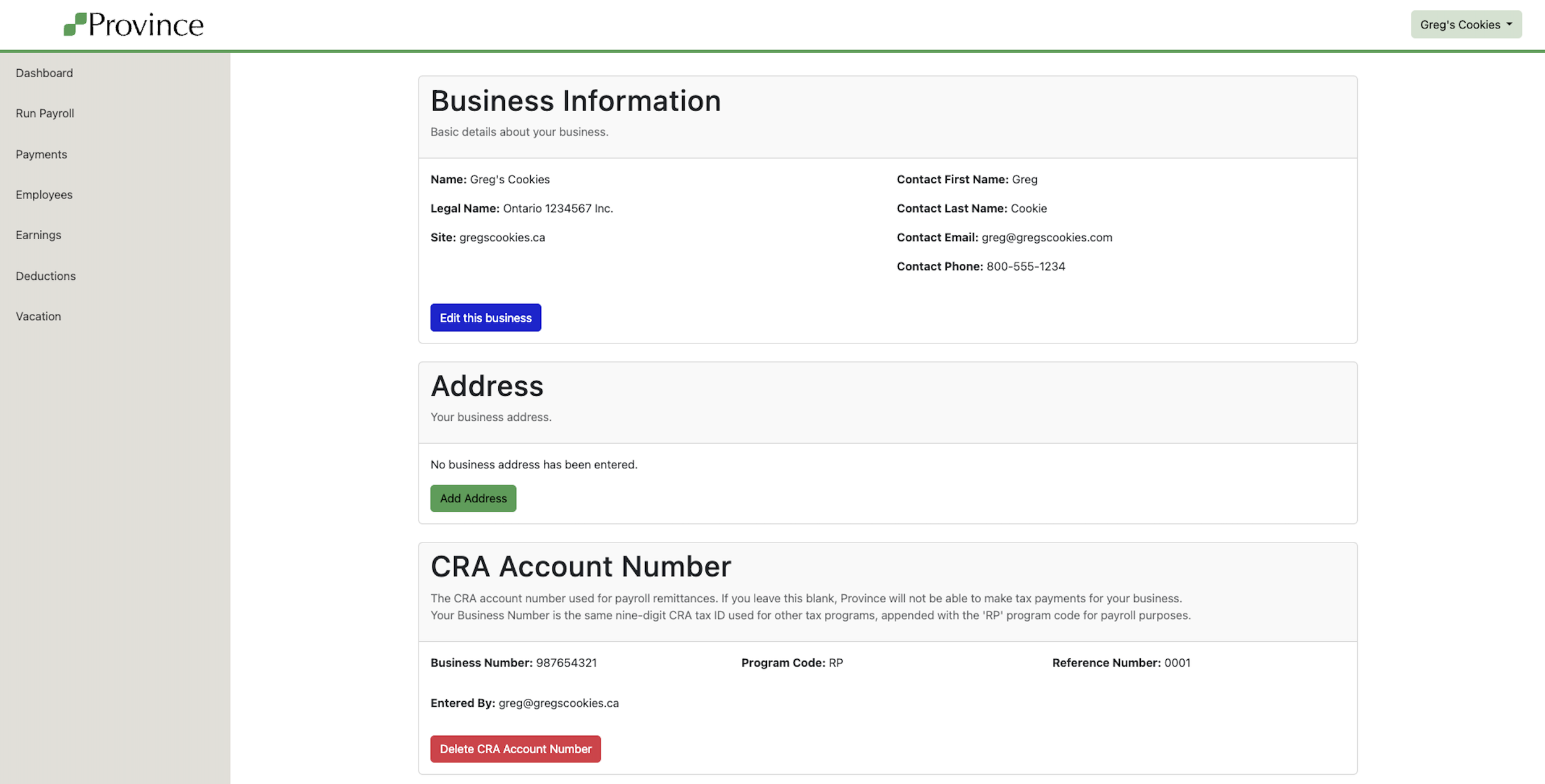

To view or update your business information, click the Business button in the top right corner of any page and select Business from the dropdown menu. You’ll land on the Business Settings page, where you’ll see five key sections.

Help Center

Business Settings

👥 Business Info

This section contains your business name and employer contact information.

Note: We collect contact information solely for communication related to Province Payroll. We never sell your contact info or use it for advertising. This ensures we can reach the right person for payroll updates, support, and reminders.

🏠 Address

Add your official business address here. This may be used for documents like T4s or ROEs, so it’s important that it stays accurate.

📄 CRA Account Number

This is your CRA Payroll Account Number used for remitting taxes.

It follows the format: 123456789RP0001, where the 9-digit Business Number is used for all CRA programs, and RP identifies it as a payroll account.

If left blank, Province will not be able to make tax payments on your behalf.

Please ensure this is entered correctly.

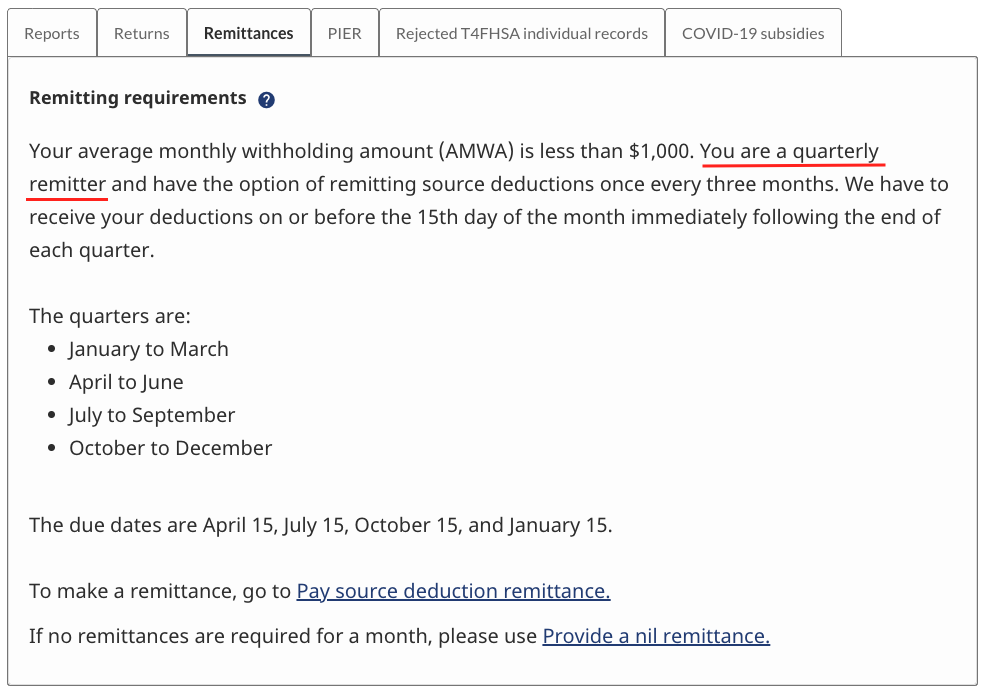

📝 CRA Remittance Frequency

This section tells Province when your payroll taxes are due. The CRA updates this information annually..

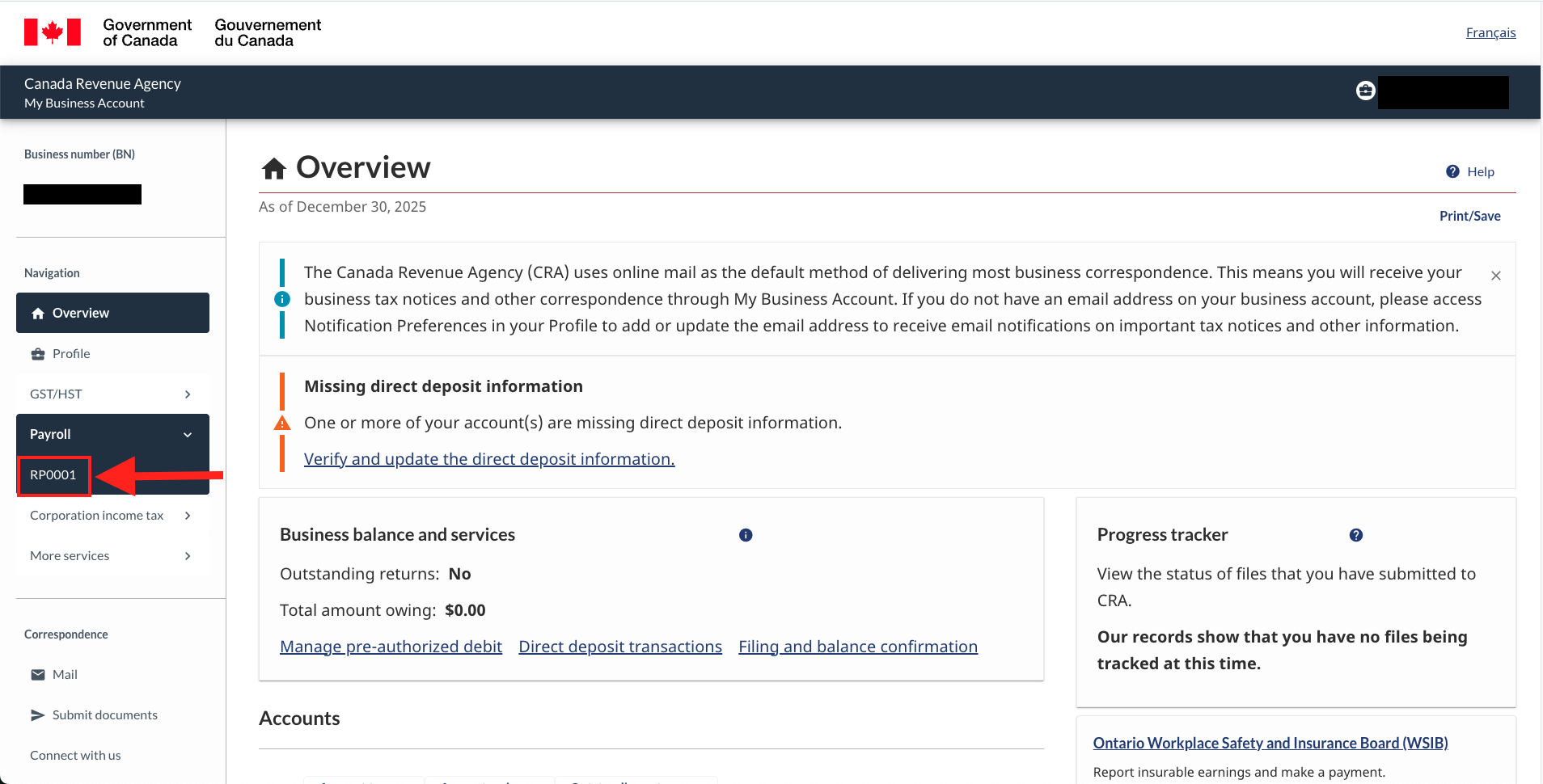

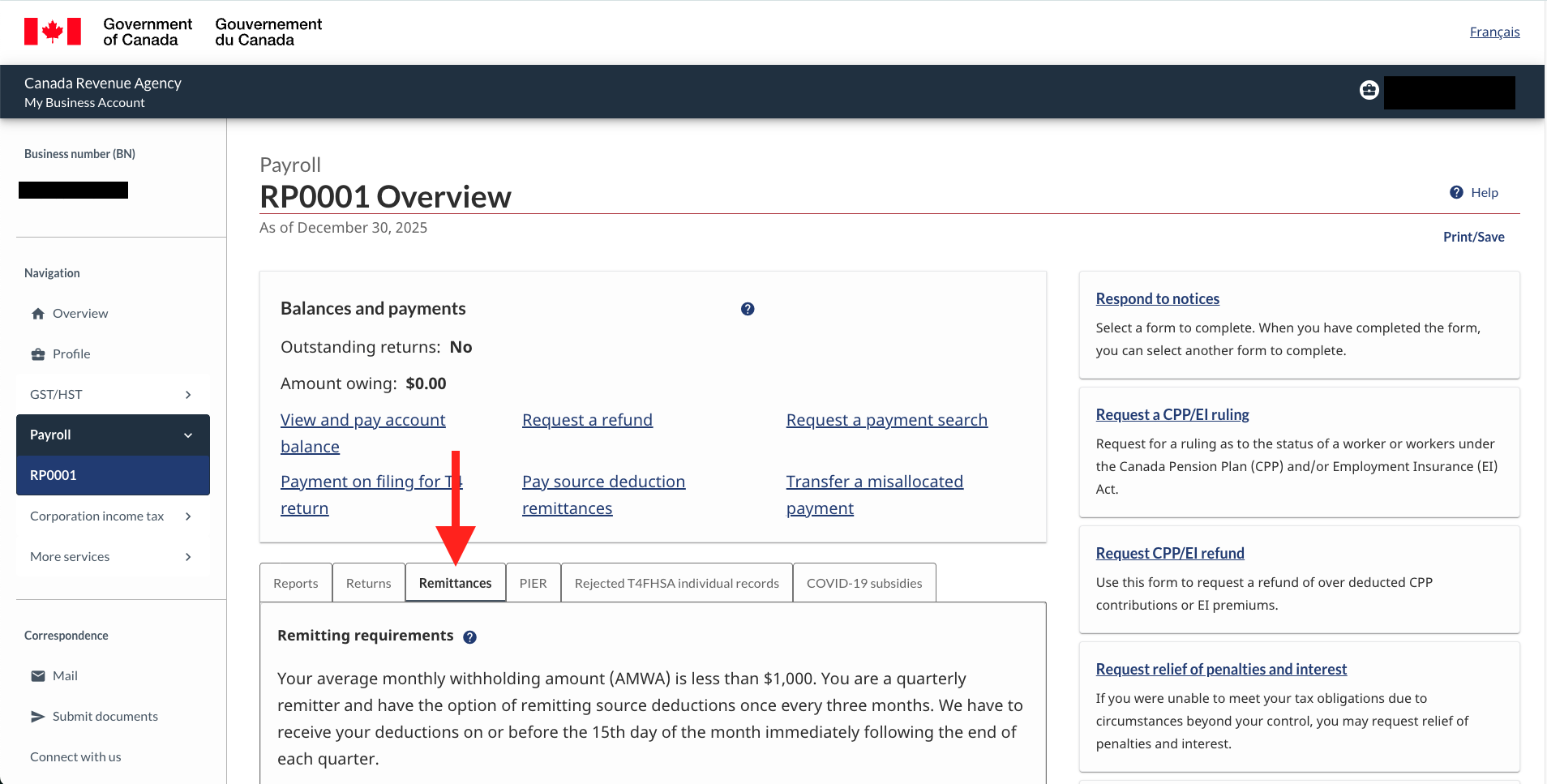

You can find your remittance frequency by logging into your CRA My Business Account under the "Payroll" section. In the screenshots below, the business is a Quarterly remitter.

To enter a new CRA Remittance Frequency:

Click Add CRA Remittance Frequency.

In the form, select your Remittance Frequency from the dropdown menu and enter the Year.

Click Save CRA Remittance Frequency to confirm.

Important Notes:

If left blank, Province defaults to Threshold 2, which has the most aggressive payment schedule. This ensures we don’t miss your payment deadlines.

You can update your frequency at any time. The new setting will apply to future pay runs. Province will not retroactively adjust tax due dates.

Best Practice: At the beginning of each year, explicitly set your CRA remittance frequency. It takes just a few seconds and helps avoid CRA penalties.

If you don’t update it, we’ll use your most recent frequency from a previous year.

⏰ Pay Run Frequency

This setting is selected during onboarding and cannot be changed once payroll has been created.

Why? Because changing a business’s pay frequency requires issuing ROEs for every employee.

If your business has changed its frequency and you need to update this setting, email us at help@provincepayroll.com.